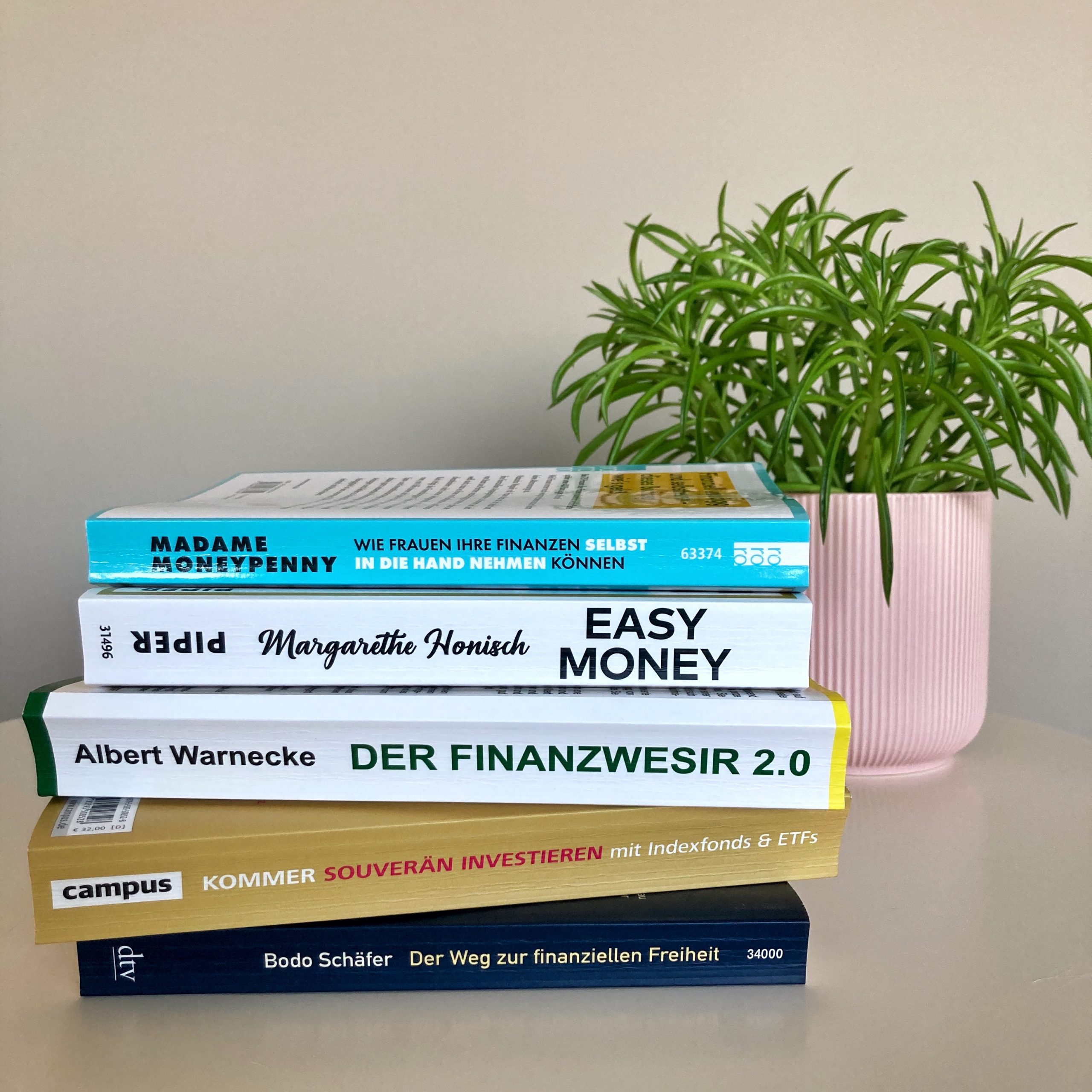

the 5 best books on personal finance books in german

you made the resolution to get your finances in order? congratulations, that’s a big step! to help you get started, i have selected the best personal finance books in german (from beginner to expert level) that i could find.

why the best personal finance books in german?

i live in luxembourg and speak five languages. as my country and the community of people speaking my mother tongue are small, it makes sense for a lot of us to look for resources on most things in other languages.

as financial things are utterly dependent on a country’s regulations, institutions and product offer, i thought it best to start with resources written in german as germany is one of our biggest direct neighbours.

i will cover resources in english in upcoming posts and i might look at french books, but so far i haven’t found any that caught me eye.

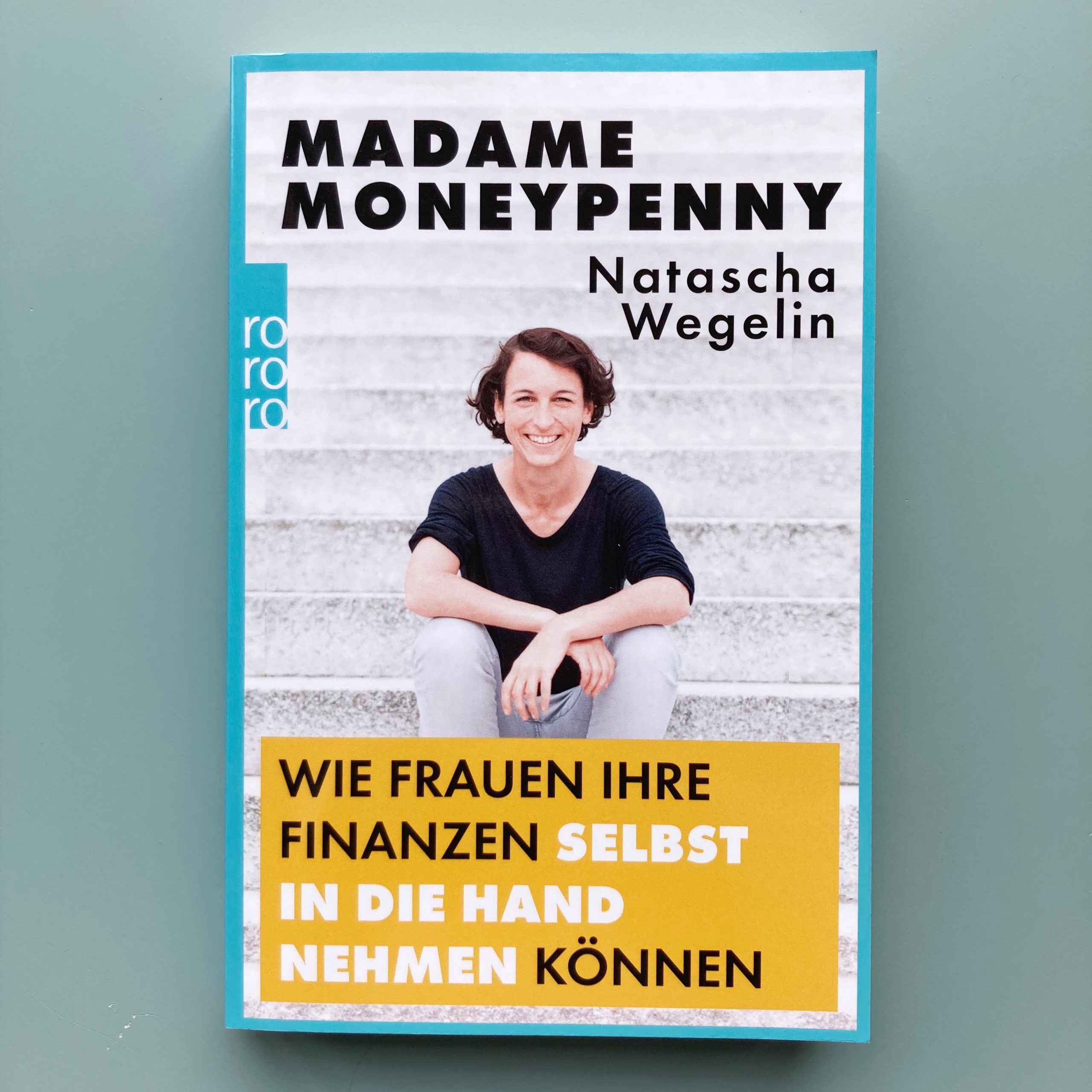

madame moneypenny by natascha wegelin

the first personal finance book in german that i can recommend is madame moneypenny by natascha wegelin. it might very well be the easiest introduction into the subject matter that you can find.

it reads like a novel because it is written like one. in the book, wegelin explains personal finance to her family over a bbq dinner. there’s dialogue and a story and lots of helpful information.

this book is for you if you have absolutely no financial knowledge AND very intimidated by the subject matter. as you’ll see reading this book, there’s nothing to be afraid of.

a bit too easy?

personally, i found this book to be written a bit too simple.

at first it almost angered me that the only book out there specifically marketed at women wrote about about personal finance in such basic terms. as if women needed things explained to them like children.

i soon realised though that due to reading other books first, i may have an advantage of knowledge on the topic that other women might not have, but can find in this book.

a strong brand

where wegelin however really shines is the community she was able to build around her brand.

name any social media, she is on it. and with her, around her, there are many, many women talking, sharing, lifting each other up. if ever you have a question or you need support, this community on facebook for instance might just have your back.

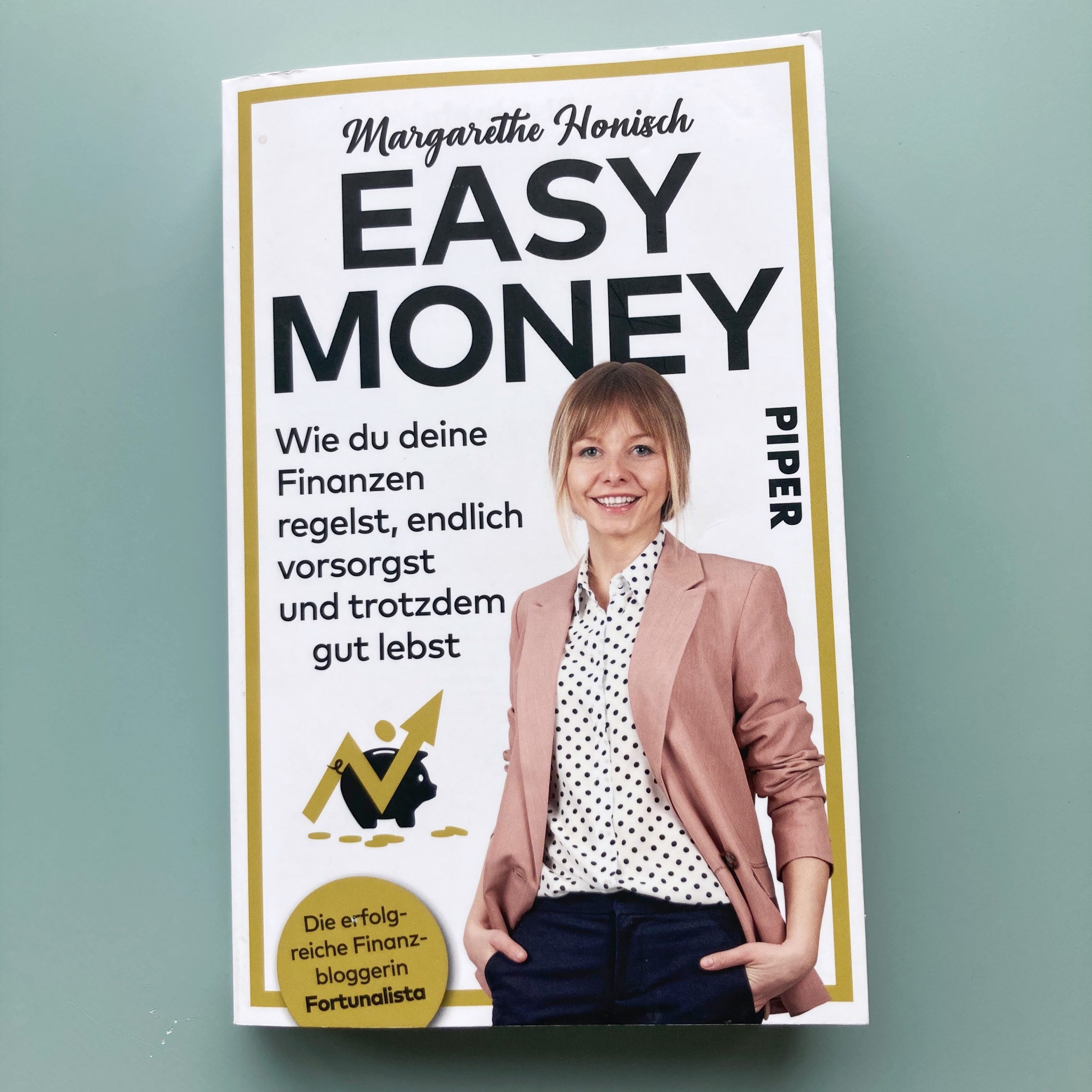

easy money by margarethe honisch

the second personal finance book in german that i can recommend is easy money by margarethe honisch.it also is an introduction into the subject matter.

if you only have the time or patience for one book on personal finance in german, make it this one!

honisch explains all relevant aspects in a fresh, funny and down to earth tone. she delivers on the promise of her book title. the information she provides is indeed easy to understand, complete, well researched and backed with evidence and facts. it is also more specifically geared towards women.

this book is for you if you have no prior knowledge into the matter and are not afraid to learn new things.

bonus tips

- i can also recommend following her on social media, as such she is known as fortunalista on instagram.

- her follow-up book ‘so wirst du finanziell frei’ illustrates the money strategies of 13 successful women. it didn’t make this list, but definitely deserves an honourable mention.

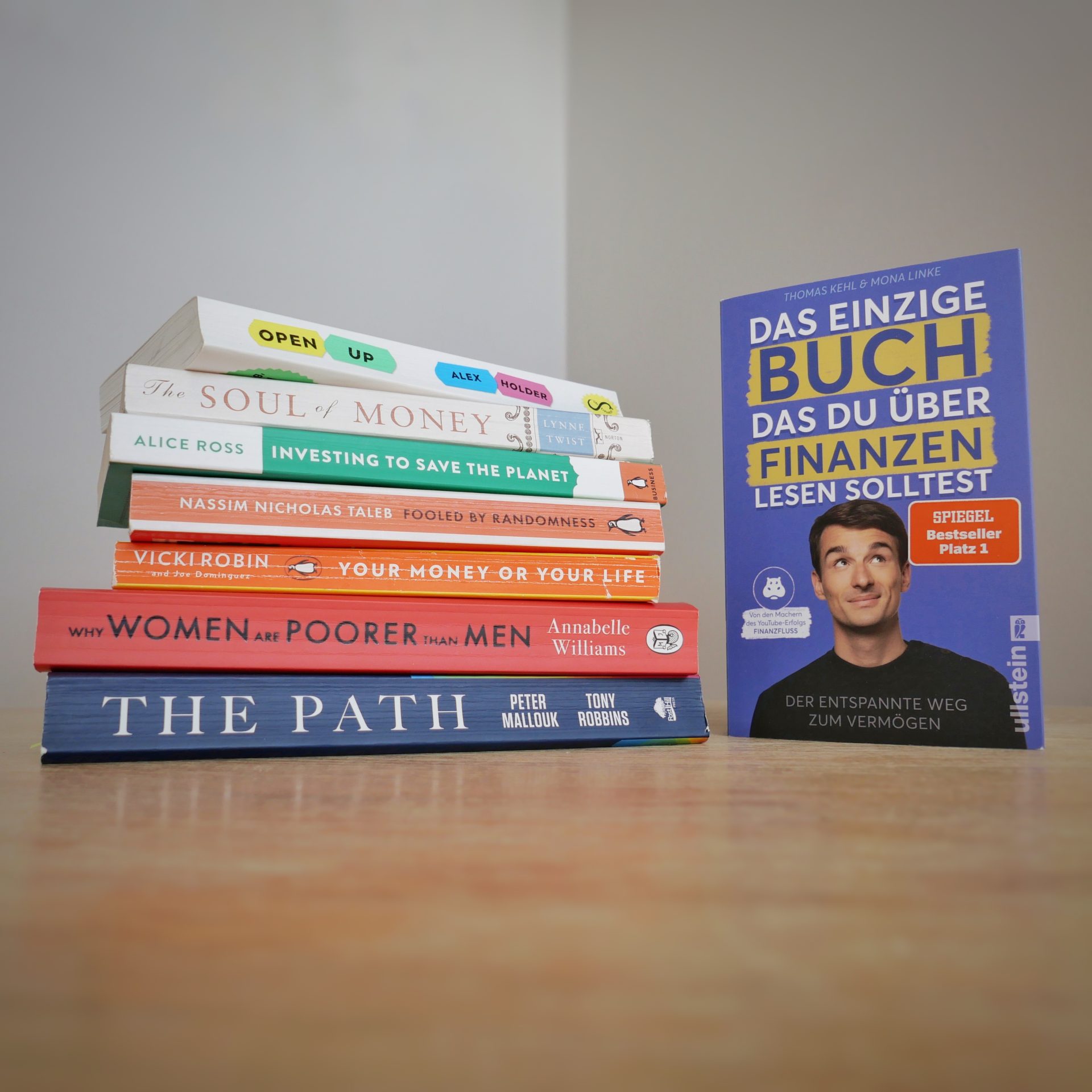

das einzige buch, das du über finanzen lesen solltest

the third book on this list is by thomas kehl und mona linke. the title is bold: they presume to have written the only book one needs to read on the topic. now, did the book rise to the challenge?

the short answer is yes.

the long answer is well… maybe. they cover the basics in enough (but not too much) detail, always provide simple, yet compelling examples and touch on virtually all aspects that could possibly be of interest. all the while evidence-based of course and with their trademark no nonsense attitude.

so, is it enough?

sure, if all you want is to read one book and be done, you should definitely check it out.

but is one book really ever enough? i guess, what i really want to say is that my beef with this book is the premise that reading any one book on any one topic could ever be enough. the issue is rather philosophical in nature, however, and has nothing to do with the quality of the content which is outstanding.

for those who need a more visual representation of these topics, i can recommend the youtube channel by finanzfluss

(kehl’s brand with arno krieder) as a complementary source of information. this channel guided me from feeling clueless about investing to opening my own portfolio a couple of years ago and i have been at it ever since. their 10 to 15 minute videos cover most of the topics mentioned in these books, are on point and up to date with current events.

der finanzwesir by albert warnecke

the next personal finance book in german that i can recommend is der finanzwesir by albert warnecke.

it starts where both madame moneypenny and easy money end : the creation of wealth by building financial assets.

once the financial basics are covered, the next logical step is to think about what to do with the money you’re not spending. and how to do it exactly. this is where warnecke comes in.

der finanzwesir is as easy, as helpful and at the same time as extensive as an introduction into the topic of investing could possibly be. warnecke doesn’t mince his words. his tone is no bullshit from the first page to the last. he tells it like he sees it after decades of personal experience in the stock market. take it or leave it.

in my opinion that’s where the real strength of this book lies. it’s our money we’re talking about. and our money is directly linked to our survival, our comfort in life and our future.

so yes, please, let’s be candid.

souverän investieren by gerd kommer

the final personal finance book in german that i can recommend is souverän investieren by gerd kommer.

expert level

kommer brings things to an expert level and this many regards.

he had me at “finanzmarktforschung” (financial market research) on the first page in chapter one. there’s scientific research on financial markets? but of course, there is. why wouldn’t there be?

kommer repeatedly and extensively quotes this research on the performance of financial markets over the past 120 or so years. and suddenly a lot of things that have nothing to do with indexfonds or etfs start to make sense.

why is is so hard to find information on financial products that i understand? for the longest time, i thought the problem was me. that i just wasn’t smart enough. therefore, reading this book was like a curtain being lifted with one aha moment after the other.

now i see it for what it is: bad marketing 101. purposefully written vague and lacking information with the goal to get you to make an appointment in order to sell you products that are more in line with the banking institution’s needs than your own.

a bit of an effort

this, however, doesn’t change the fact that kommer’s writing is dense, intellectual and so refined it sometimes comes over a bit blasé. but then again, they don’t call him the ‘pope’ of indexfund investing for nothing. credit where credit is due. and that is here.

my personal conclusion : this book isn’t a walk in the park (it took me 4-5 weekends to read 395 pages) but bloody necessary.

to freely quote kommer : don’t invest in what you don’t understand.

this book gets you a lot closer to understanding.

der weg zur finanziellen freiheit by bodo schäfer

this leaves us with other popular personal finance books in german such as der web zur finanziellen freiheit by bodo schäfer. there are more, but let’s just take this one as an example.

now, there is nothing per se wrong with the information in this particular book. it all seems factually more or less correct to my amateur knowledge.

the problem with his book, however, are the unreasonable expectations that it raises : ‘your first million in 7 years’. i’m not saying it’s impossible, but to get there would mean an extremely frugal saving’s rate, immense entrepreneurial success and an overperforming stock market portfolio over 7 entire years.

or in other words : it would take enormous dedication and sacrifice, immense genius and the dumbest of luck.

i hate to be the one to destroy the fairy tale : but that’s maybe a 1 in a million combination and that one person may be you, but statistically speaking it isn’t.

so you might just as well prepare yourself with the knowledge you need should that one person turn out not to be you.